how are property taxes calculated at closing in florida

In florida you should expect to pay. Heres how to calculate property taxes for the seller and buyer at closing.

Tax Tips For Selling A House In Florida Florida Cash Home Buyers

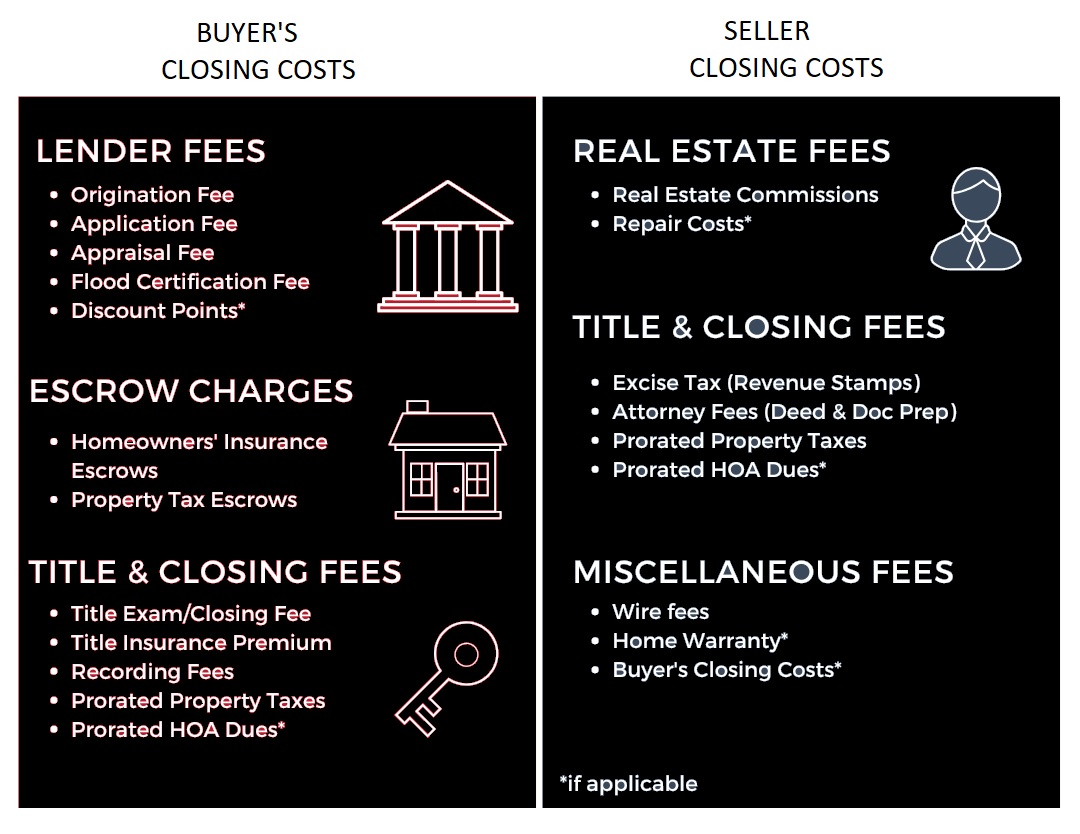

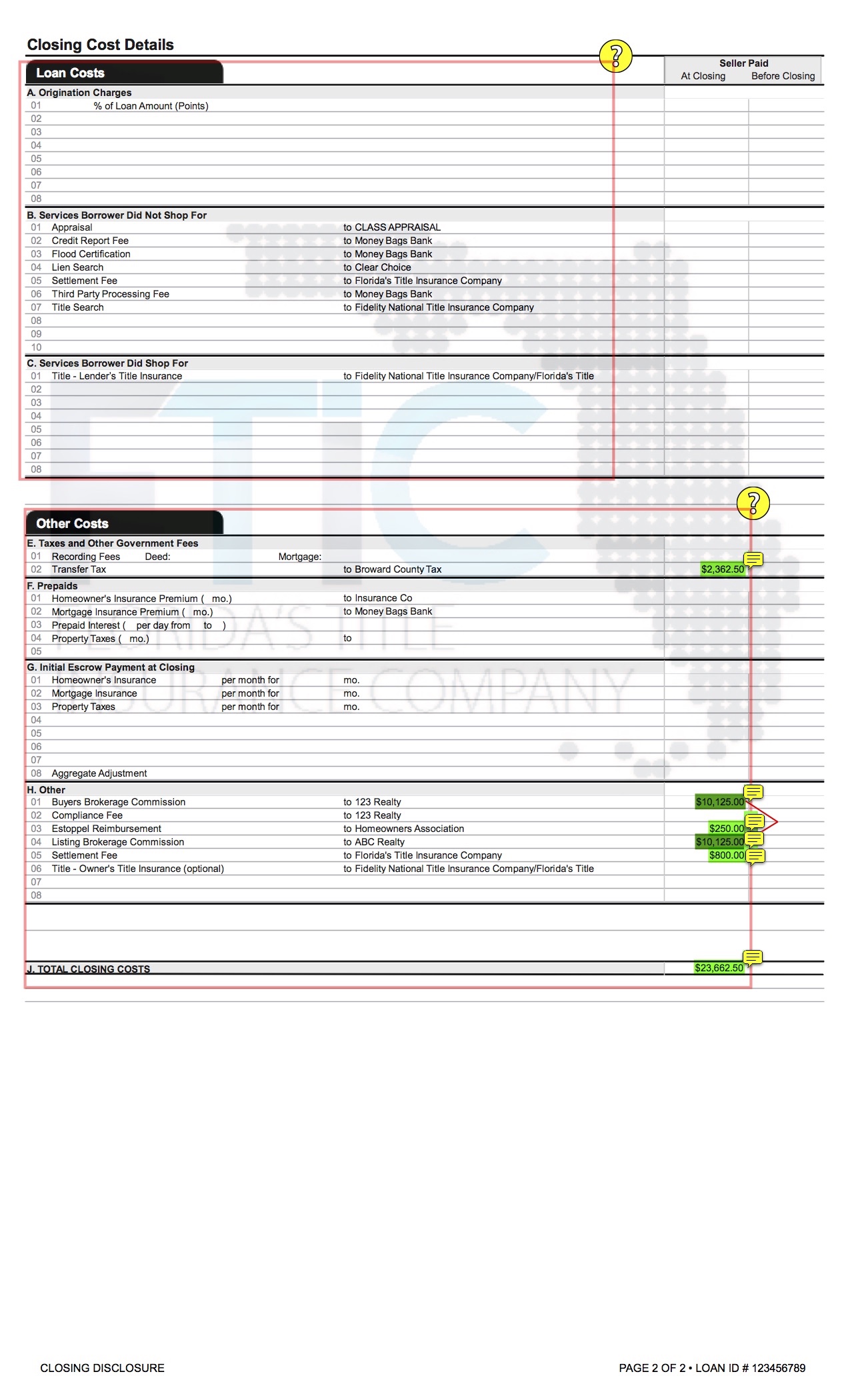

In Florida if you sell your home with a conventional realtor youll generally pay between 56 in total real estate agent commissions at closing.

. 097 of home value Tax amount varies by county The median property tax in Florida is 177300 per year for a home worth. Receipts are then dispensed to related entities per an allocation agreement. At the moment you can expect to pay between 205 and 274 of the total purchase price before taxes.

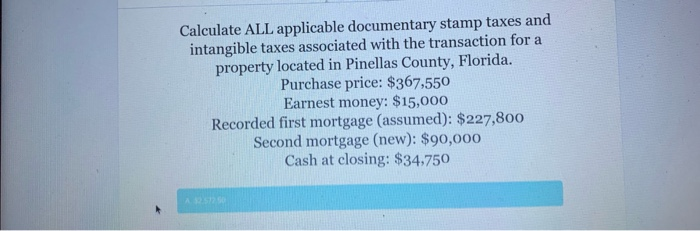

In Florida transfer taxes are also referred to as documentary stamps or doc stamps and theyre typically paid by the seller. This is an easy formula that you can use to quickly get the prorated property tax that you can advise to your. Instead the seller will typically pay between 5 to 10 of the sales price and the.

The pro-ration of the property taxes between the buyer and seller becomes a little less precise when the closing date falls between January and the date the actual property tax. Since property taxes are based on the prior year when the tax bill finally comes all parties involved should re-prorate the taxes in order to determine who owes what. Generally at closing the Seller pays property taxes dating from January 1 of that year until the date of closing.

4200 12 350 per month. Figuring out the amount of your doc stamps. Divide the total annual amount due by 12 months to get a monthly amount due.

253 goes to your listing. How are property taxes handled at a closing in florida. Most often the taxes are collected under one assessment from the county.

This proration accounts for the time that the Seller still owned. During the home closing process the title company youre working with will prorate the taxes between the buyer and the seller at closing based on the closing date. Overall there are three stages to real.

Frequently asked questions about Florida Real Estate Closings by Larry Tolchinsky Esq. Taxable Value X Millage Rate Total Tax Liability For example a homestead has a just value of 300000 an accumulated 40000 in Save Our Homes SOH protections and a homestead. Call us Today at.

Florida Property Taxes Go To Different State 177300 Avg. - Real Estate Attorney with 25 yrs of exp. Average closing costs in Florida The average closing costs in.

In Florida property taxes have an average effective rate. Proportion Calculation - X sellers of days total amount tax 365 days. Because Florida has a 6 sales tax local sales tax ordinances can result in an increase in the state sales tax to 85.

Solved Calculate All Applicable Documentary Stamp Taxes And Chegg Com

Your Guide To Closing Costs As A Buyer Or Seller Homesnap

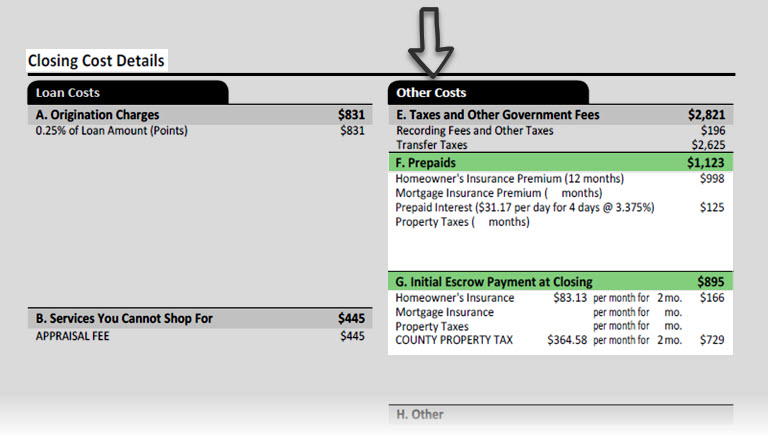

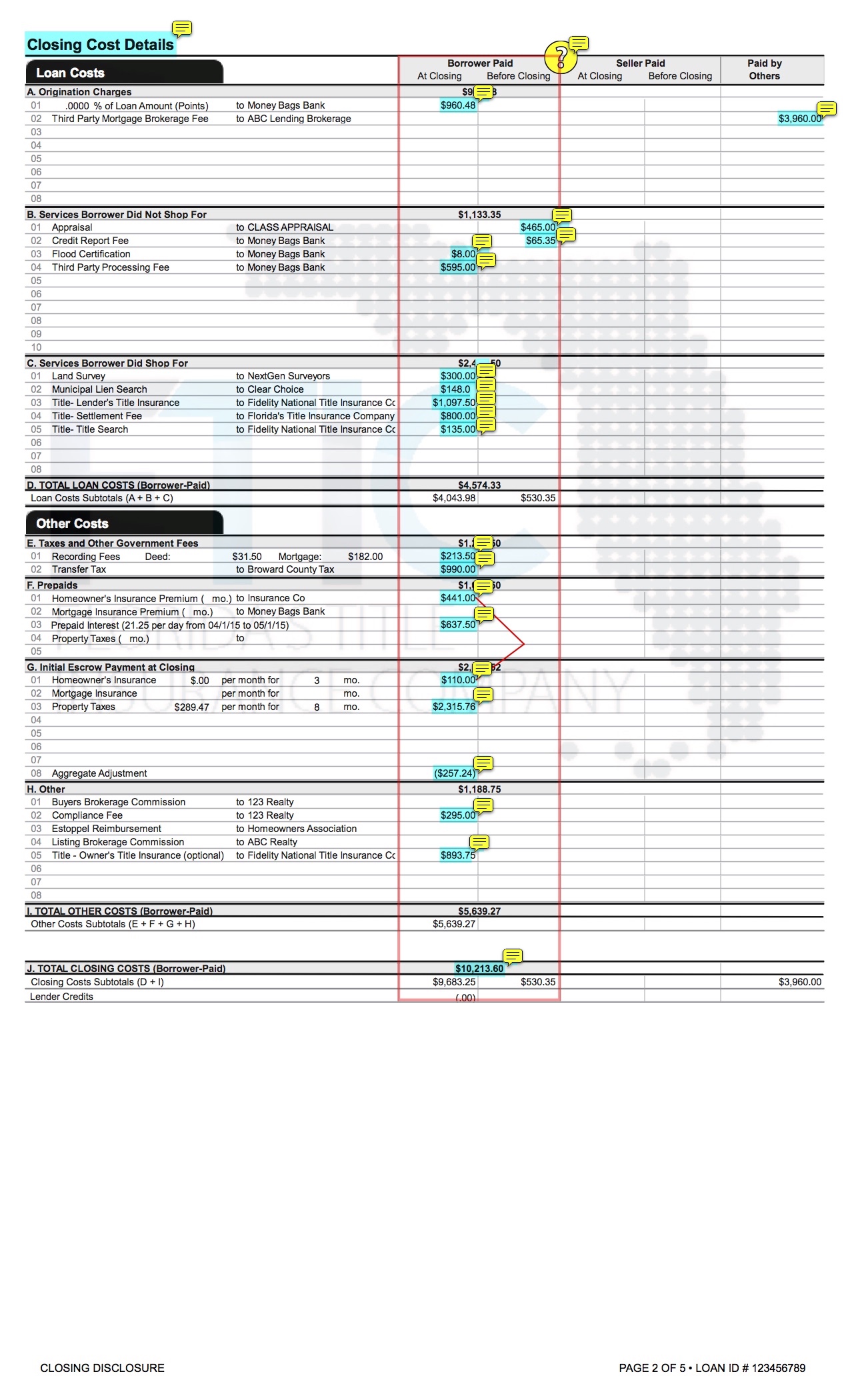

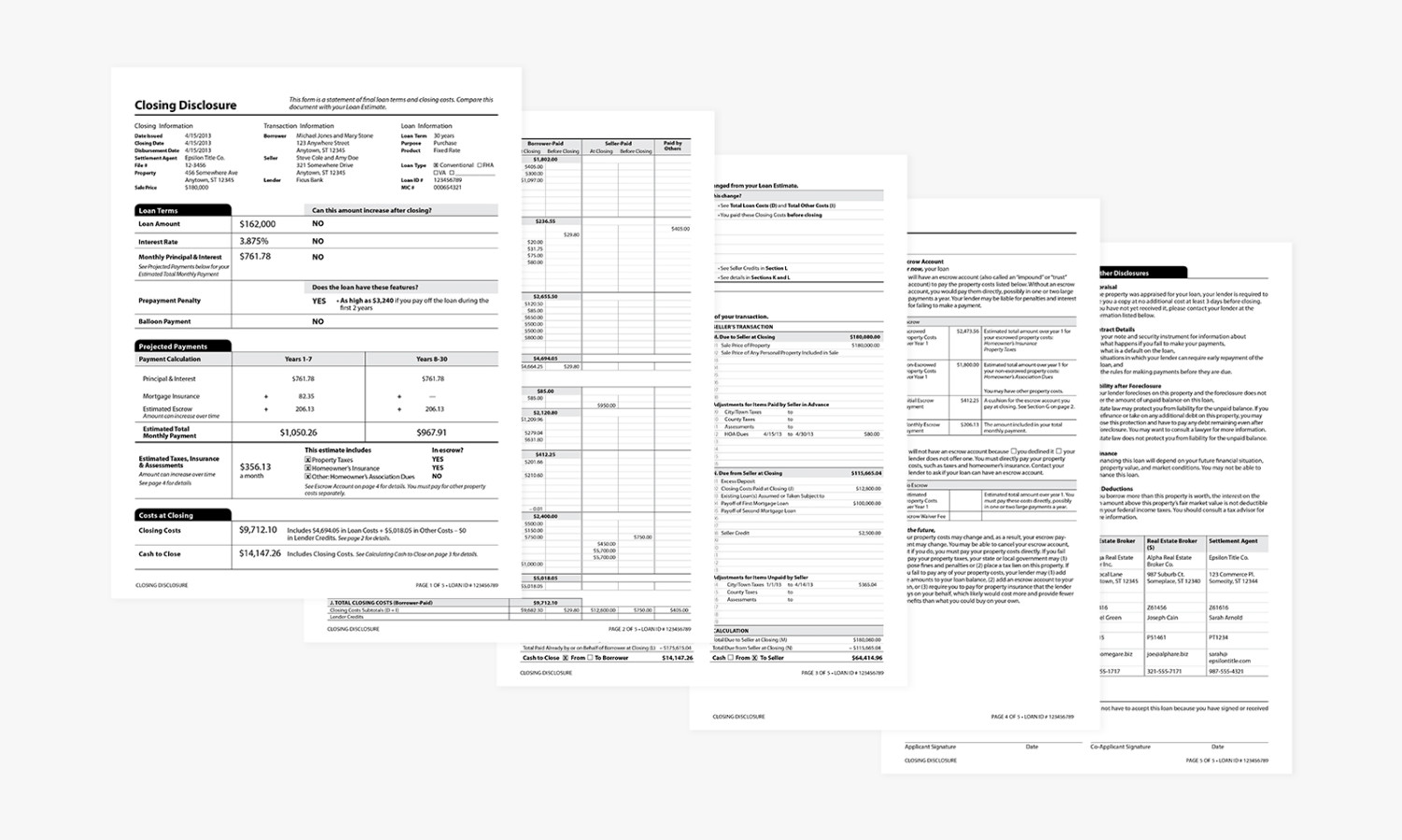

How To Comply With The Closing Disclosure S Three Day Rule Alta Blog

Your Guide To Prorated Taxes In A Real Estate Transaction

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company

Closing Costs In Florida What You Need To Know

How Much Does It Cost To Sell A House Zillow

Closing Costs In Florida What Sellers Need To Know

Buyer And Seller Costs During The Fl Home Buying Process Deloach Hofstra Cavonis P A

A Guide To Understanding Your Closing Disclosure Better Better Mortgage

Nyc Mansion Tax Calculator For Buyers Interactive Hauseit

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company

Virginia Property Tax Calculator Smartasset Com

Your Real Property Tax Bill When Selling Or Buying Real Estate Real Estate Law Blog

How To Read Seller S Closing Disclosure I E Seller S Closing Costs Florida S Title Insurance Company

/alta-sellers-closing-statement-26837264d4044785a5d0409dae83a510.jpg)